It’s day 35 of Lent. How do I know? I don’t.

My abs however do. I’ve done 3,500 sit-ups. 100-a-day for the last 35 days.

To be fair, this is the first time I’ve actually stuck with something through Lent and I wasn’t even raised Catholic (I’m Christian) and you are asking how that draws me closer to God? You can be sure my mommy-flabby-abs and I are desperately praying, “Dear God, when will this end?!”

Here’s the cool thing about doing something consistently. I’m damn proud of myself and it feels so good to be proud of yourself. I’ve decided that I’m going to continue the sit-ups after Lent. They make me feel good. I can actually suck in my stomach now when need be, like when entering and leaving the hot tub in my bathing suit and I can almost feel my muscles under their nice comforter when I flex them. (They stay warm. I feel sorry for those poor abs that have to be exposed to the elements without a nice comfy blanket. 😉 )

Here’s the thing. I really do suck at consistency. The one thing I can say I’ve done 90 times in a row is this blog. That is it! Creating and keeping good habits are not my strong suit, and I know as humans we aren’t programmed to have consistency and persistency come naturally to us.

Habits = Work

What you do every day matters more than what you do every once in a while.

Accomplishing great goals takes consistent persistent action.

I was having an internal yelling match in my head with one of my business coaches, wondering why my business wasn’t where I wanted it yet. I wanted to know why I haven’t “made it” yet. Then she asked me and our whole group of entrepreneurs, “Well, how long have you been doing X?” And I replied, “Maybe 5-6 weeks for this one thing, maybe 6 months for other things?!”

She said, “Come back and let’s talk once you’ve been doing it for 2-5 years consistently.” BOOM to my head. Yah, duh!

Yup, somehow we think that doing things a handful of times (like exercise, eating healthy, selling something, growing something, etc.) should yield us the results we want. It rarely works that way.

We all want the over-night success that we think we see others have, however we don’t stop to consider the small actions that we need to take today to make us great one day. (One day, people will meet me and think my business and author fame (LOL) happened overnight, however, it really took over 17 years consistently staying in the same industry doing the same job, not jumping from industry to industry or job to job. Sure, there may have been minor detours to figure stuff out, but overall, I’ve been consistent in what I’ve done. Many people I know have not.)

It blows my mind why people think that I’m amazing because I wrote a book.

Let me re-assure you that I’m not uber amazing (just semi-amazing!)

All I did was write a little every day.

If you write 1000 words a day, then in 50 days you will have a 50,000-word book too!

The problem is that we haven’t habitualized (I made it up!) what is really important to us.

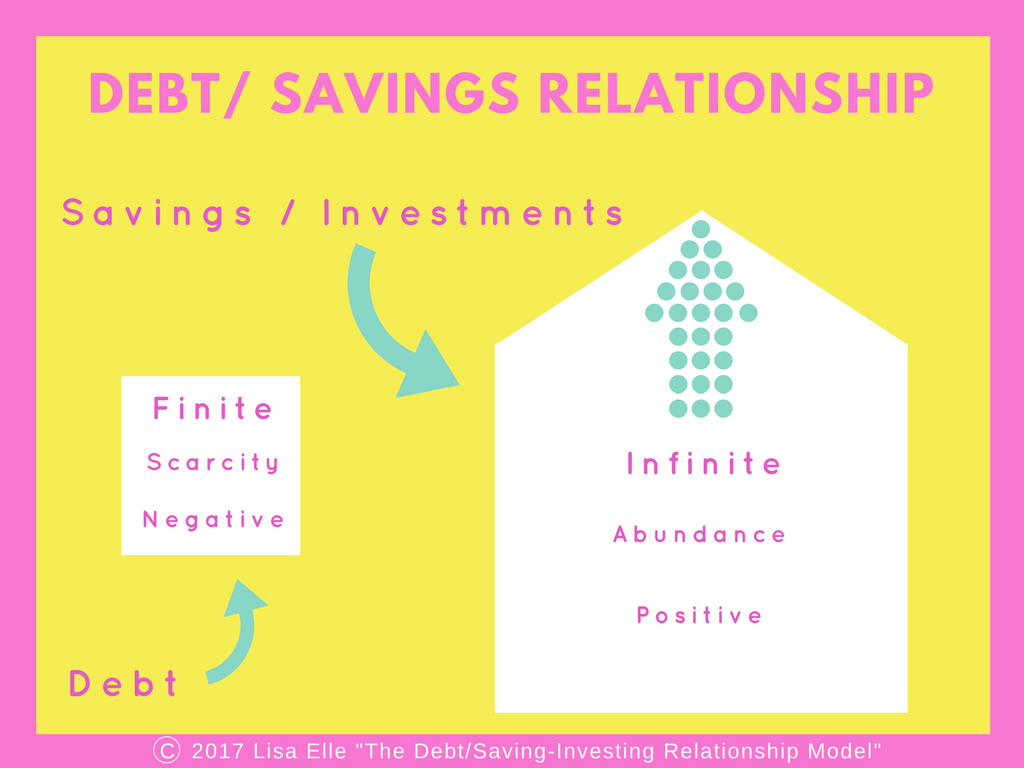

Do you ever wonder why some people are rich, even though they make the same amount of money that you make? It’s because they saved better than you did. My guess is that they started good savings habits early on, then one day you stand side-by-side a person who saved and one who didn’t save, yet still earned the same throughout all their years, and their net worth will be dramatically different.

Yesterday, I was really hard on myself while I was doing my morning journaling. I back engineered what I want to be known for in my life and what kind of leader I want to be, and then wrote out the habits that will get me there.

I came up with a few new habits I need to start making non-negotiable. (Don’t do them all at once – that may be too hard, add them in slowly to your routine! Just speaking from personal experience – being in a feeling of overwhelm is a sure way to make you NOT do anything habitually!)

I love this quote:

Everyone must choose one of two pains:

The pain of discipline or the pain of regret.

What do you choose?

What do you really want from life?

I encourage you to back engineer your goals to figure out what habits done consistently are going to get you there.

Is it writing, learning, practicing a skill, saving, messaging, giving, loving, exercising, diet?

And then once you figure out your new non-negotiable daily habits.

Do THEM!

Do THEM!

Do THEM!

No exception. It may take 1 or 2 or 10 years, but I can guarantee YOU WILL BE GREAT at it and go off to ACCOMPLISH GREAT THINGS!

And above all, you will FEEL AMAZING!

Want to learn how to feel amazing about your financial situation? Join me for Wealth Spa Workshop at Wealth Ranch in Cochrane on Saturday, May 13 from 10am – 1pm. Cost is $99. Message me for details at lisa@ellementsgroup.com