Symptoms, Causes, and Coping with Nycklendyme Syndrome

Nycklendyme Syndrome is a disease I’ve struggled with first hand and in recent years got worse, before it got better. In this bold article, I’ve decided to break the silence and share from my heart for the benefit of others suffering this terrible syndrome.

I may have had a few run-ins with it before I had children, however having children exasperated this particular diseases. I consulted with my physician on the matter. Dr. Google agreed that in most cases, Nycklendyme Syndrome is caused by having children.

Fantastic! I can add Nycklendyme Syndrome to the long list of “Things Children Give Us” rivaling amazing cheerio art and stretch marks.

I first realized I was experiencing these symptoms when I opened my bank account and saw all these small transactions.

“The Oompa-Loompas are at it again!”

I declared, out loud, in a Wicked Witch of the West cackle, staring at my online banking account, sipping my coffee, plotting my revenge.

You may find yourself having outrageous outburst toward your online banking account! Don’t be surprised if you find yourself talking like Dr. Evil, Cruella DeVille, or Donald Trump – just know that these are usually the first signs Nycklendyme. Symptoms also include the “feeling of being broke and having no clue where all your money goes!”

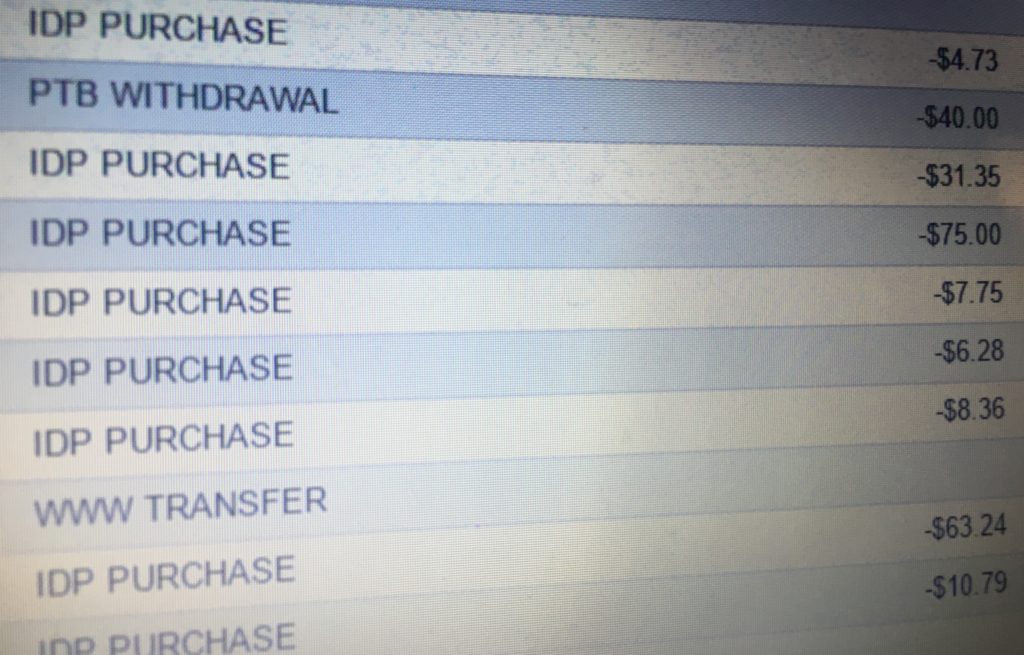

Your account may look something like this: (WARNING: PHOTO NOT SUITABLE FOR YOUNG CHILDREN, NAGGING PARENTS, SPO– USES THAT LIVE IN A BUBBLE, PREGNANT WOMEN, AND PEOPLE WITH HIGH BLOOD PRESSURE!)

As I mentioned previous, this can be a very serious disease, usually brought on by “cute kids” that you just can’t say no to. If you have “cute kids”, you may want to check your bank account and see if the Oompa-Loompas have gotten to it as well.

They say 9 out of 10 people with children have some form of Nycklendyme Syndrome. The 1 out of 10 people who do not fall prey to this HORRIBLE disease has what we refer to in the industry as a “budget”. This is another type of disease altogether, and these people usually have the magic powers of putting people to sleep at cocktail parties.

This disease progresses slowly. As you age, your income usually increases, and instep with your increasing income, so does Nycklendyme. It may start out as innocently as Medium Timmy’s Coffee and maybe a quick trip to the dollar store. In its final stages, it looks like a university degree coupled with a Venti Skinny Vanilla Latte from Starbucks twice a day, and a Coach Handbag or designer jeans for good measure. It definitely gets worse over time.

Another sign that you might have Nycklendyme Syndrome is that you occasionally may look like this:

or this…….

NOT TO PANIC!!!! There is a solution – and no it is NOT a “BUDGET”. We already decided we weren’t going to be “those people”.

There is a super easy way to rid yourself of Nycklendyme Syndrome. You will need to meet up with your local Certified Cashflow Specialist for your prescription.

However, if you can’t make it to your CCS today, then start with this simple tip.

Take out your allocated spending amount for the week in cold hard CASH and keep your cards at home!

This will instantly alleviate most of the Nycklendyme Syndrome and make sure you aren’t mindlessly overspending.

BOTTOM LINE: Nycklendyme is a real disease that affects millions of people and millions of dollars every day. Please help us put an end to Nycklendyme – make sure to know where your money is and where it’s going, before it affects you too!