Dollar-Cost Averaging

I’m going to teach you how to KISS and RELAX today.

Okay, okay – Maybe I won’t really teach you how to KISS per se (although, I must say I have this uncanny ability to turn frogs into Princes!), but I will teach you how to Keep It Simple Simple and RELAX when it comes to investing!

The best way to do that is Dollar-Cost Averaging!

DCA – WTH?

Dollar-Cost Averaging is when you buy a little every month, or as often as you can and you dollar-cost your way into quality investments.

Why is DCA brilliant? Because you can still make money (for the most part) in a sideways or flat or volatile market. I don’t want to start a hot debate over this subject, however, you can decide for yourself.

Reviewing years of research on this subject, if you had dollar cost averaged into a quality investment fund or stock, you minimize your long term risk and increase your rate of return. This isn’t a cure-all, and doesn’t protect against a falling market. At the end of the day, I believe DCA allows for most people to sleep better at night. So I do encourage you if you are investing money anyways, to consider this strategy.

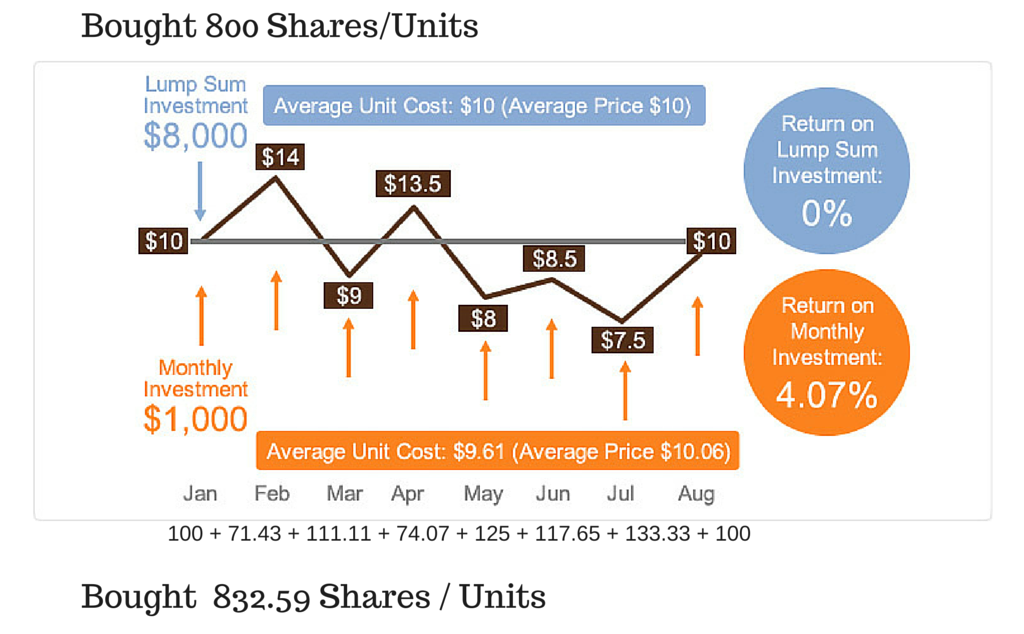

Let’s take a quick look at the graph below as an example.

Ok – lets take a closer look at this chart. This is an example of a volatile sideways market for the most part. The top half represents an $8000 lump sum deposit once into a mutual fund or stock and watching it over an 8 month period. The bottom represents buying $1000 a month over 8 months. In both scenarios, at the end of 8 months, you have invested a total of $8000.

With the top illustration, you would see your investments fluctuate over the course of those 8 months. In the example above, in the month of July you would most likely be freaking out that your portfolio is down about 25%. Although, then in August, you would be relieved to know you are back even-steven.

With the bottom illustration, you would see your investments fluctuate as well, however, in month 1 you only have 1/8th of your total planned investment at risk because technically, the other $7000 is still in the bank so-to-speak, so you don’t really lose too much sleep over it. By month 8, you have been buying a little every month, so the fluctuations and crazy volatility (the ups and downs) doesn’t bother you because a) you still hold quality companies, and b) when you are buying low, you are buying more units or shares of the quality stock or companies that you own in your portfolio.

In the end you see that in a sideways market, or volatile market, there is still a way to make money. (FYI – There are always ways to make money in any given market, even if you are shorting stocks and betting that the market will go down…..enter: The BIG SHORT – go see that MOVIE if you haven’t!)

Now, if the underlying investment needs a boot out of your portfolio, then I do not recommend DCA. If you have reviewed your portfolio and it holds quality companies that you still believe in, then DCA is probably the best strategy that you can implement.

Now, for the million dollar question I get asked all the time.

When is it a good time to buy? Yesterday!

People always ask me if there is a good time to buy, get in the market. The best time was yesterday. There is no good time. This next statement is probably much older than I. It’s not timing the markets, it’s time in the markets that counts. It’s like waiting for a good time to have kids! Hahahaha – anyone who has kids KNOWS there is NO good time to have kids! You just go for it, and go for it with gusto…jump in both feet and don’t look back!

And don’t forget to KISS all the time – if you can! That’s right, you can say that your financial coach said the KISS is always the best route to a great relaxing day!