THE SKY IS FALLING! That is what it feels like for most of us in Alberta right now. As a resource heavy province where a substantial amount of jobs are oil and gas related, hence why most of my conversations with clients, friends, family and random strangers seem to end up in doom and gloom talks about how bad this year is going to be for our economy. (Although, I have personally tried to do my part to boost the economy by buying more shoes, however, I feel my efforts are in vain. 🙂 )

Most of these feelings stem from a place of fear and worry, and not only are they doing emotional and financial damage to your life they are also robbing you of today’s possibilities, happiness and the enjoyment of being in the moment.

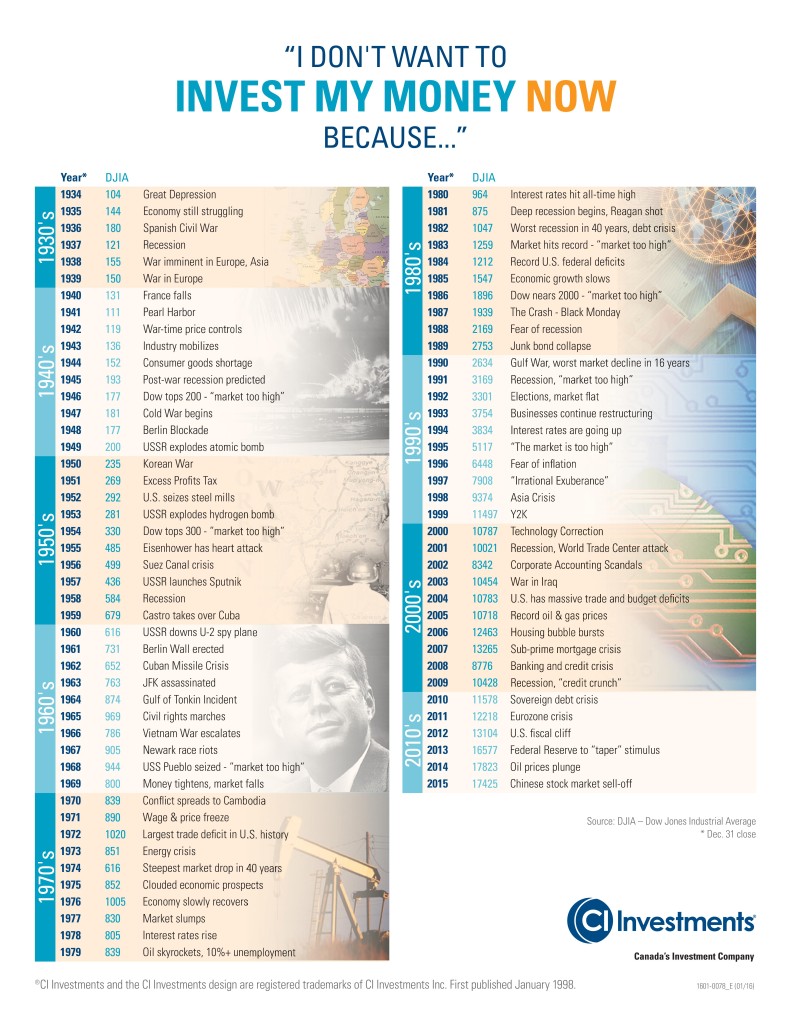

I think this is what happens. We get all concerned about ‘stuff’ that is out of our control, and we become notorious to try to make sense out of our crazy world.

GUESS WHAT! The world will NEVER REALLY MAKE SENSE!

So what do you do when the political party you didn’t vote for gets into power? You lost your job? Or the market drops 10% in one day? Or someone completely freaks out at you for no good reason? Or you think the world is coming to an end and your Shmita is over?

These have been my biggest struggles: WORRY! FEAR! FREAKIN’ CONTROL ISSUES! (Do I hear an AMEN?!)

I remember fear from the first time my cousin taught me about global warming in grade 4 and I remember having nightmares and thinking the world would end. I don’t think I slept for days because I was scared that the world would heat up like a big ball of fire the next day.

I also stored up a basement full of water and food for the end of the world in 2012 – We are still eating the rice and the occasional canned good!

Fast forward to now.

I still get freaked out about the things I can’t control, but now they aren’t consuming my time or pulling me away from my passion the way they used to because I’ve done this simple exercise that I’ve outlined below.

I believe we are all here for a reason, and we all have amazing gifts to share with the world. The problem is when we are letting fear and worry run rampant in our heads, like a kid-on-popping-candy-sugar-high, it will stop us dead in our tracks from accomplishing our purpose.

This is how you handle fear and worry:

You take a piece of paper. Draw a line down the middle.

On one side you write “All the Things in my Control” and on the other side you write “All the Things Not in my Control” and then you list them.

For myself, this is what was on my list of “What I Control”:

All the Things in my Control

- Run/Walk/Fresh Air for an hour a day

- Write for an hour a day

- Call X number of clients a day

- Send LOVE to my family and friends

- LOVE like crazy on my 2 girls

- Put myself out there with my message everyday

- Watch what & how much goes into my mouth

- Design my living space as a place I enjoy so I can love where I write, work & live

- Vote

- Be respectful of others

- Learn – Gather Information to help others or to make an informed decision

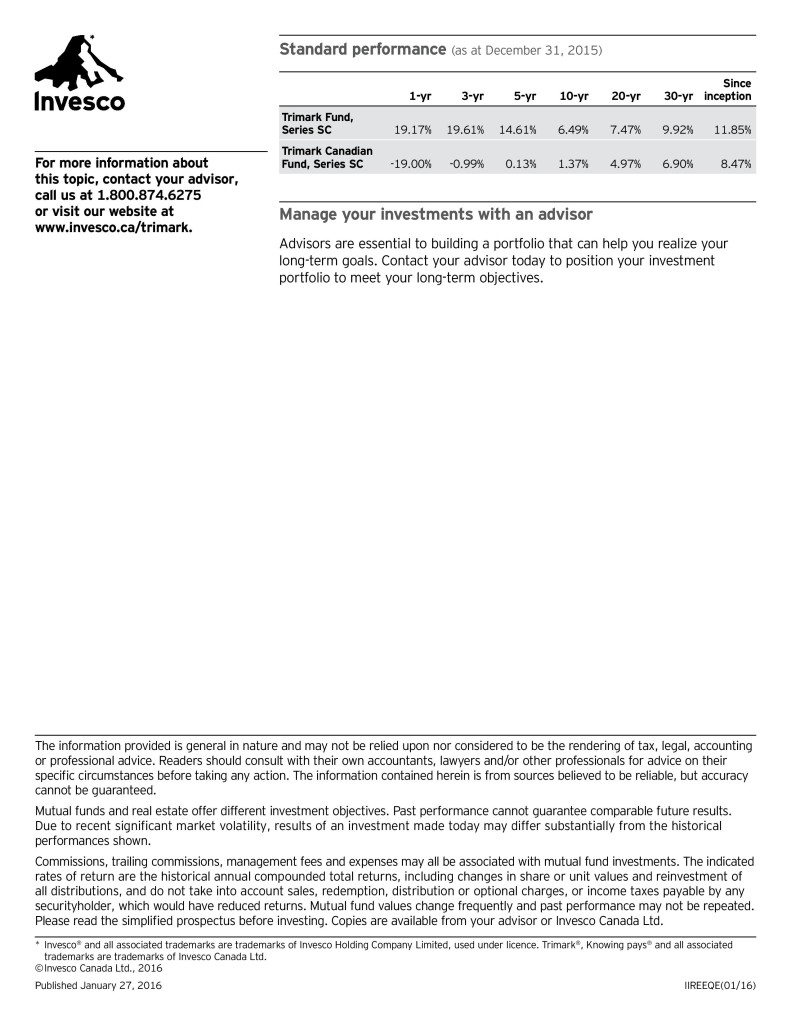

- Save Money

- Create a Financial Plan, Business Plan, Launch Plan, Life Plan, Exercise Plan

- Listen to others! (That one I’ve gotten way better at over the years – but still is a struggle – I like to talk!)

Your list will look different of course – but it will be similar in many ways.

All the Things Not in my Control:

- Politics

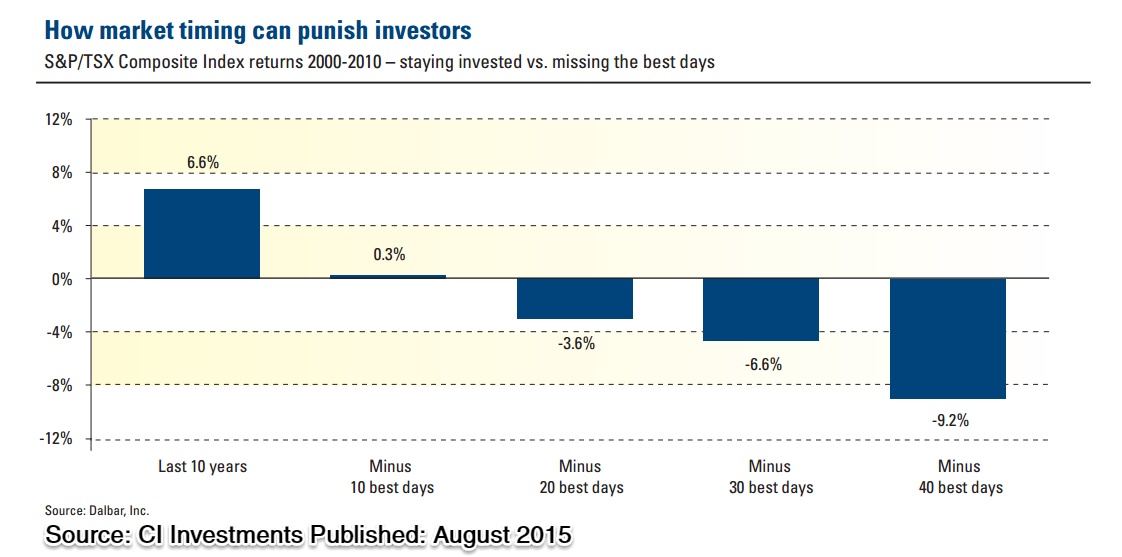

- Stock Market

- Economy

- Weather

- How people respond to you

- Outcomes

- Medical Tests

- How people treat you

- Being put on this earth and getting booted off!

The sooner you stop focusing on the things you can’t control and begin to TAKE ACTION on the things you can control, you will immediately feel better – worry and fear will leave you and only come back if you invite them.

Take Action. Be in action on what you control.

What would our world look like if we stopped feeding the “NOISE” in our lives we can’t control and started listening, helping and encouraging others with that time?

Let GO of what you can’t control.

Someone very wise once said “Do not worry about tomorrow, for tomorrow will bring its own worries.”

As seen in Trifecta Magazine Spring 2016