The Debt / Savings Relationship Model

Have I got your attention yet?

I’ve been asked this question numerous times throughout my career, and then 5 times this week alone!

SHOULD I SAVE/INVEST MONEY OR PAY DOWN MY DEBT?

or better yet,

WHY SHOULD I SAVE/INVEST MONEY @ 2% WHEN MY DEBT IS @3%?

or any variation on that question.

I have a DAMN good answer to this questions and trust me I’m going to say something here that I’m certain I will get backlash from SO many people (mostly middle-aged older men in my industry – which let’s be honest is like 80% of the financial industry).

The people who won’t understand this post are the people who are left-brain thinkers, accountants, numbers people, people who are so logical that they can’t for the life of them see past the black and white of math. They are also the people who follow all the rules and aren’t my first choice to invite to a party until you secretly spike their coffee and then proceed to party like it’s 1999 because they really REALLY believed in Y2K. These people most likely don’t have any debt. So if this is you – this ISN’T for you! You are restrained and we need people like you in the world (and we love you!). So go off and enjoy your spreadsheet!

This post is for EVERYBODY else. Everyone who has debt. Everyone who has ever got a new credit card and instantly booked an all-inclusive to Mexico for 2 weeks when they were 19 or ran away to Vegas and left a note on the kitchen table telling her parents that she just went to Vegas with a boy that she was strictly only friends with or ran out and bought a new pair of shoes. (Because I would NEVER EVER EVER do that – who are her parent’s anyways?!? Hi Mom & Dad!) 😉 Right, like you never did those things!

OKAY – so are you with me?!?

This is why I love math – because it is black and white on paper, however, in reality, the whole world is sitting in a pure muck of GRAY!

We aren’t stupid! Come on – everybody, including my 3rd graders, knows that it’s better to pay down debt at 3% versus saving at 2%. It’s a NO BRAINER! Right?

WRONG!

I’m going to say something unheard of from a financial person.

Sometimes NUMBERS DON’T MATTER!

Wanna know why numbers don’t matter? Because when it comes to our money we are emotional and we make all our decisions mostly on emotion versus logic. ALL of our purchases are EMOTIONAL! We are created as EMOTIONAL CREATURES! And how we think about our money is far more powerful than any number! Here is the deal and I’m going to walk you through this very carefully, and again this isn’t for everyone, but probably most of us, of course as with anything – always consult your financial/tax professional. There are a million different scenarios, so there never is a right answer for everyone, however, I still want you to understand this concept from the SPIRITUAL/LAW OF ATTRACTION/POSITIVE THINKING side of things.

I see so many clients totally stressed out about their debt, sometimes to the point where it keeps them up at night and even makes them sick. So this is serious stuff.

What I want you to consider is that once you are maxed out with debt (aka, you have a mortgage, car, a few credit cards – LIKE MOST OF US CANADIANS!) that your debt probably won’t be growing by leaps and bounds. And for most of us who have a house and maxed out credit cards, chances are the banks aren’t going to be lending you too much more money, or at least you are stressed out enough about your debt not to be taking on new debt. So in other words, your emotion in relation to debt is pretty maxed out. You are feeling stress because of this. Keep in mind this has NO number attached to it! I have clients that stress out over $12,000 worth of debt and others that don’t care that they have $1,000,000 of debt. SERIOUSLY, I’m strictly not talking numbers but the feelings you have inside of you toward your debt. Even if you aren’t stressed out by your debt, you are still probably carrying negative feelings towards it.

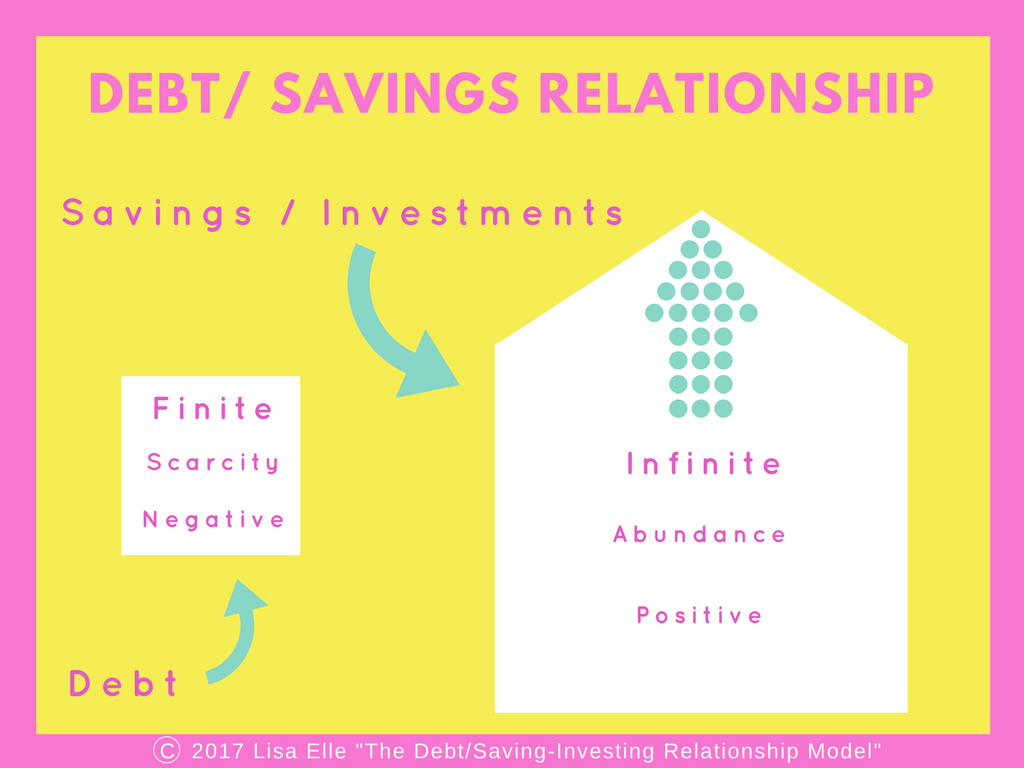

Your debt is in a box. Your debt for the most part is FINITE. It is negative on your balance sheet. It is a NEGATIVE EMOTION within you. It also reminds you of what you don’t have, or the LACK or SCARCITY in your life. Your debt can NOT grow to infinity! This is good news! Do you sometimes wonder why you feel you can never get ahead?

As Tony Robbins says, “What you think about you bring about.”

Or the Law of Attraction: “That which is like itself is drawn to itself.”

So right here it’s important to make a plan with your debt. Minus any major inheritance or lottery winnings, you need to set an amortization schedule for your debt and make a plan to have it paid off – whether it is 10-20-25 years. Most people have a 25-year mortgage, so let’s go with that.

Make a plan for your debt and FORGET ABOUT IT!

OKAY, next part of this.

I want you to save money. I preached this last week on self-worth, and I will preach it again sista.

SAVE MONEY.

Again, I don’t care if your employer is ‘saving’ money for you (pension, RSPs), or you are waiting for some big pile of money from your dead rich uncle, I want you TODAY to make a plan and save money!

This is why. When you save money you create a POSITIVE FEELING INSIDE. You are adding to your spirit, your self-worth. You are ATTRACTING ABUNDANCE. You are focusing on “adding” not “subtracting”. The other reason is that liquid money is always important for things like emergencies (having an emergency fund), or being able to take advantage of investment opportunities as they arise.

Who cares if you are only getting 2% on your savings while your debt is getting paid down at 3%? This is where numbers don’t matter. The feeling that saving money is creating inside of you is worth far more than your actual savings! You are feeling proud of yourself. You are feeling positive! You are doing so much more than just saving money and this will begin to show up in other areas of your life. Never underestimate the POWER of a CONFIDENT WOMAN! (or man!)

When you have loads of debt (like large sums over $100,000) you feel like you will never be able to pay it off because it is insurmountable. You are in overwhelm.

Here’s the other BIG IDEA, which I’ve kinda already alluded to.

YOUR DEBT IS FINITE and YOUR WEALTH/SAVINGS/INVESTMENTS ARE INFINITE!

YES, INFINITE! You can grow your wealth to the sky! No one is going to stop you. Your debt, on the other hand, will eventually go to zero, it can’t go below zero.

I created a graphic to illustrate this. (See my Debt/Saving Relationship Model Graphic!)

Now, keep in mind this isn’t for everyone. If you have a ton of liquid assets and a small amount of debt, and that small amount of debt is stressing you out, then take out some money and pay it off. Hopefully, you learned your lesson and won’t get into debt again. If paying off debt creates a massive positive feeling inside of you – THEN DO IT!

However, here is the reality of this my dear friends. Most of us may pay off a credit card and rack it right up again. Let’s face it, we live in a society where it’s virtually impossible to get away without one. Plus, isn’t it always funny that something comes up financially right after you paid down your credit card?! Hmmmmm, think about that.

Because of behavioral psychology, I know and you deep down know that we need to almost trick ourselves or come up with a foolproof plan to get rid of debt while being able to enjoy the fruits of our labour and accomplish our savings goals. This is truly possible by the way.

I believe you can have it all! And, yes, that does mean debt-free (and yes, that is the ultimate goal!)

So start your infinity account today!

Make sure you are signed up for my insider’s info & money tools! And you really need to sign up for my Money Makeover Online Course if you really want to take your money game to the next level!