TAX FILING MADE SIMPLE

HAHA! I tricked you! No one can make tax filing FUN! (If you thought that was even a remote possibility you may be due for a career as an accountant!) However, I will try to make tax filing simple for you this year!

There are only 2 ways to file your taxes: either you file them or you have an accountant do it for you.

Option #1 – Accountant Route

In Canada, for over 100 years, we used to have different accounting designations (CA = Chartered Accountant, CGA = Certified General Accountant, CMA = Certified Management Accountant) as of this year, now they have all banned together to form the CPA (Chartered Professional Accountant).

So, if you are getting your taxes completed, I recommend you find a CPA. Easy, and done! It’s always nice to find one that is self-employed, from my experience they will charge less than a fancy accounting firm. Google is a great resource to hunt down one of these beauties!

I have a few referral accountants for the Calgary and Cochrane area that are affordable and fantastic – just email me at lisa@ellementsgroup.com and I’ll send over their information. Also, if you are an accountant – send me your info! It’s always great to expand the network!

Option #2 – You File

I personally don’t recommend this, because no matter how good your software is it really can’t know your dreams, future plans, and provide best advice. However, if you have a “job” and a simple T4 with a few slips like RRSPs or donations, then a simple NETFILE software product will suit you just fine.

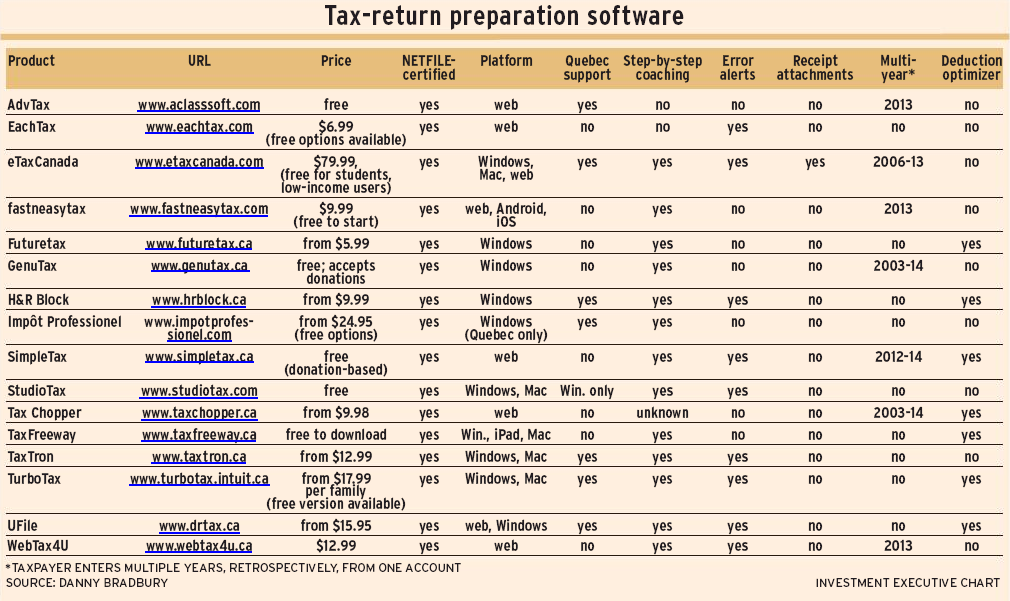

I came across this delightful little tax-return preparation software chart to help you wade the mucky waters of self-filing from Investment Executive by Danny Bradbury (October 2015).

Check it out and I hope you find tax time a little easier this year!