Why are we here?

What if I told you that you had access to the best online financial education platform in Canada, the top independent financial planners at your disposal and a way to grow your wealth for you and your family by referral?

That’s what The Wealth Collective™ Program is. It’s a powerful system created to transform the financial industry! Getting professional advice, 24/7 accessibility to your pressing money questions, personal financial accountability, creating income and building your wealth and access to over 300 hours of financial education in our membership library.

What does a Certified Financial Planner (CFP) actually do for me and my family?

In a nutshell, CFPs provide holistic financial advice and look at the entire financial picture of your life and not just one area, such as your investments only. There are so many moving parts and they all tie into together. Your CFP will help you bring together a FULL financial picture of your entire financial life all driven by your goals.

What if I already have a financial advisor, accountant, lawyer or investment advisor that I work with?

Great! That’s amazing that you are working with qualified professionals.

This is what we offer you: a second option.

Sometimes you just want a second opinion on your situation from a fiduciary (someone who has your best interests at heart) and you want to know all the options available to you. We are happy to help you with that.

That is all part of our service. You don’t need to have any products, investment accounts, insurance policies with us in order for us to help you with a review. And you also don’t need to move those accounts. That’s why we are here – to help you further your knowledge, options available to you and help you create wealth in your own way! For everyone that looks different.

Also, many of you may have family members as financial advisors – we understand this, but maybe they aren’t the person you want to be telling “all” your financial problems or worries to. We are here to help you and guide you through this. We see this all the time, clients needing a non-obligation secondary opinion or additional services not provided by their current agent, advisor or institution. We are happy to provide that for you.

Is this a conflict with my current direct selling company or network marketing firm?

No, this is not a conflict as you are not selling anything, only referring to Wealth Spa™. This is another income stream, and it is considered a referral program.

How do I get people to sign up?

Once you are an affiliate, you receive your own affiliate link that is unique to you. Your referrals sign up at this link and you receive your monthly referral fee.

Also, we are here to support you and we are happy to help present this opportunity to your referrals, over zoom, in person or phone call – we are happy to help you generate referrals.

Are there any quotas or monthly quotas or check-ins?

No, there are no quotas. The objective is to encourage our referrals to have access to the best financial education, top financial planner and other professionals and implement their financial plan so they can fund their dreams. There is nothing mandatory about this program, however we encourage you to utilize all the tools and wealth professionals available to you to grow your wealth!

Is there a cancellation fee?

No, you can stop your monthly fees at anytime. All fees are non-refundable.

If you do cancel, you will have access to the Wealth Spa™ content for the duration of the month but it will expire on the last day of the month.

You must be current on your monthly payments to be able to be a part of the Wealth Collective Affiliate Program.

How do I cancel my membership?

To cancel your membership at anytime, please log into your PayPal account. Click on the top bar “SUMMARY” then look for the transaction called “Recurring Payment from Ellements Financial Group” and click on it. Then it will take you to the “Transaction Details” screen where you will click on “View Recurring Payment Details” which will open up a new screen that lists all your recurring payments called “My Preapproved Payments”. There you will click on Ellements Financial Group which will lead you to the “Recurring Payment Details” page where you can click the “Cancel” button at the top of the page and then confirm once again in the pop-out screen.

How do I transfer my affiliate referral income into my regular bank account?

Once you login to your PayPal account, you will see an account balance in the top left hand corner that you can transfer into your personal banking account.

Click on “MONEY” on the top bar. Then scroll down to “Bank Accounts” and click on the “Link a New Bank Account” and follow the steps.

What if I miss a payment?

We understand life happens and credit card issues are happening all the time! You will have a 30-day grace period to contact us and pay your missed payment to remain active in the Wealth Collective Referral Program. We will also reach out to you when you have a missed payment.

How do I pay for my Wealth Collective Referral Program?

You will need to have a PayPal account set up in your own personal name or business name and link your credit card or bank account to the PayPal account to pay your monthly.

Can I pay annually?

No, unfortunately, this program and the affiliate payout program is all based upon monthly payments at this time. This could change in the future with technology changes, but for now is a monthly payment.

How do I receive my referral fee?

You will receive your referral fees in your PayPal account that you signed up with on the 20th of each month. You will need to transfer the funds from your PayPal account to your personal bank account. You are responsible for all the income you collect and will report it as earned income for tax purposes. You will not receive any tax forms or statements from us at tax time.

When do I get paid as an affiliate from my referrals?

If you are a Wealth Collective referral partner, you will be paid on referrals that sign up under your special URL link on the 20th of the month following your referral’s purchase. E.g. If you have a referral who signs up on the first of the month, then you will be paid on that referral on the 20th of the following month. Referral fees are paid on the following month the fees are collected in.

If I cancel my membership, can I still be an affiliate and refer?

No, unfortunately, you can not be an affiliate if you cancel your membership.

What happens to my referrals if I quit?

Your referrals that you were being paid on will either roll up to Ellements Financial Group or be divided or passed out to other referral partners in the Wealth Collective Affiliate Program. Ellements Financial Group reserves the right to distribute referrals to others referral partners as we see fit.

How much do I get paid as an affiliate?

You get paid 50% after fees and taxes as an affiliate. Ellements Financial Group collects all the funds and from there we pay the PayPal Processing Fees (which is about 3%) and 5% GST and then we split the remaining amount which works out to 46% to our affiliates. That is why you will see 46% on your affiliate payout schedule. You do not have to remit GST on your income as we have remitted it for the full amount.

- Your Payout As Affiliate —> 46%

- Ellements Financial Group —> 46%

- PayPal Fees & 5% GST —> 8%

- TOTAL —> 100%

Are there bonuses and how does that work?

YES! We have bonuses for our affiliates! There is only one bonus paid per level you reach, so you can not receive a bonus more than once. Also, the bonuses are paid essentially 3 months after you’ve hit your target, or 2 full commission cycles after.

E.g. You have 3 referrals as of September 17, your third person just signed up on September 17th. These referrals must stay on for the month of October as well (meaning we’ve received income for your 3 referrals for 60 days or the months of September and October in this case) and will be paid out to you on the November 27th.

Bonuses are calculated on the first of every month based on how many referrals you have on the last day of the month and tracked. Then the bonuses are paid out on the 27th of each month providing you’ve had your referrals in place for a FULL 2 months previous.

Level 1 Bonus: $250 CDN for 3 Active Referrals

Level 2 Bonus: $1000 CDN for 10 Active Referrals

Level 3 Bonus: $2,500 CDN for 25 Active Referrals

PayPal Email ID Confusion:

The email you sign up with on our moneybosscollective.com site may differ from your PayPal Email ID which you log into PayPal with. Just to note: you can have different emails, and that our login systems are different than your PayPal purchases. If you are unsure of which email you used, please reach out to our team.

Which Facebook Group is used for The Wealth Collective?

This is the Facebook Group for paid members only. We use the Wealth Spa™ Group as it is for all our paid members. Please click below to join:

https://www.facebook.com/groups/wealthspamembers

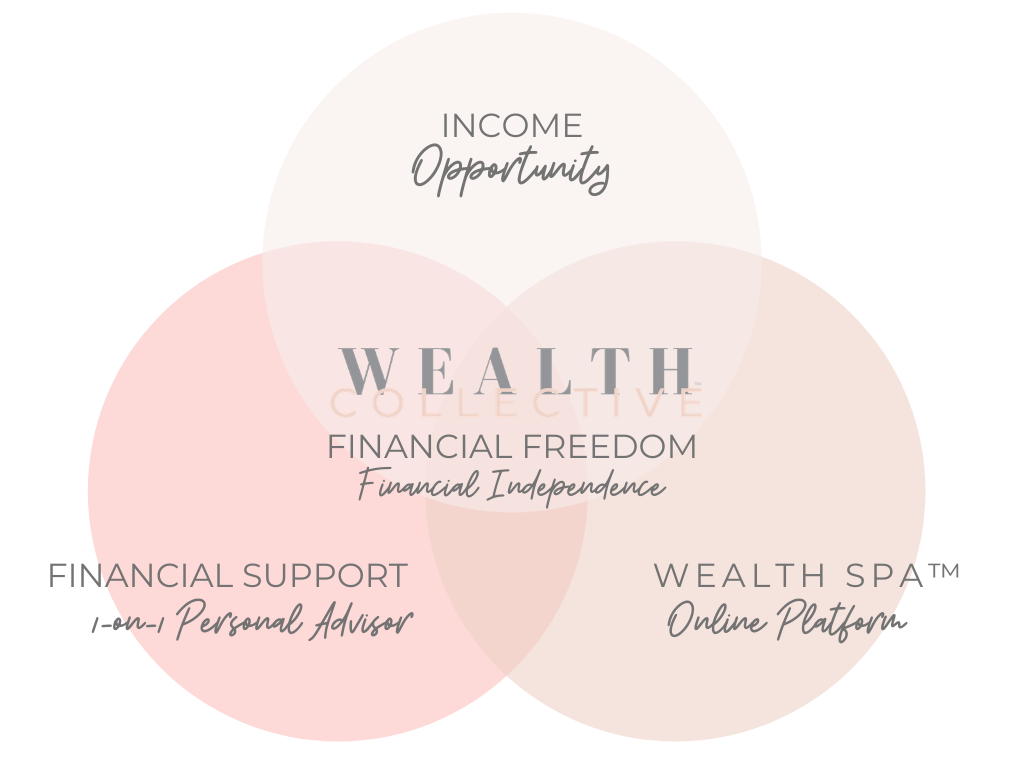

What are the 3 main objectives of the Wealth Collective Referral Program or the TRIFECTA?

- Top Online Financial Education through Wealth Spa™ Online

- 1-on-1 Personal Financial Advice & Financial Reviews through a Qualified Independent Financial Planner {all your money questions answered}

- An opportunity to create an additional stream of income through our referral program.

This trifecta of awesomeness is exactly how you and your family will create financial clarity, fund your dreams and live your legacy!